Individual Life Cycle. For the full list of personal tax reliefs in Malaysia as of the assessment year 2021 read on.

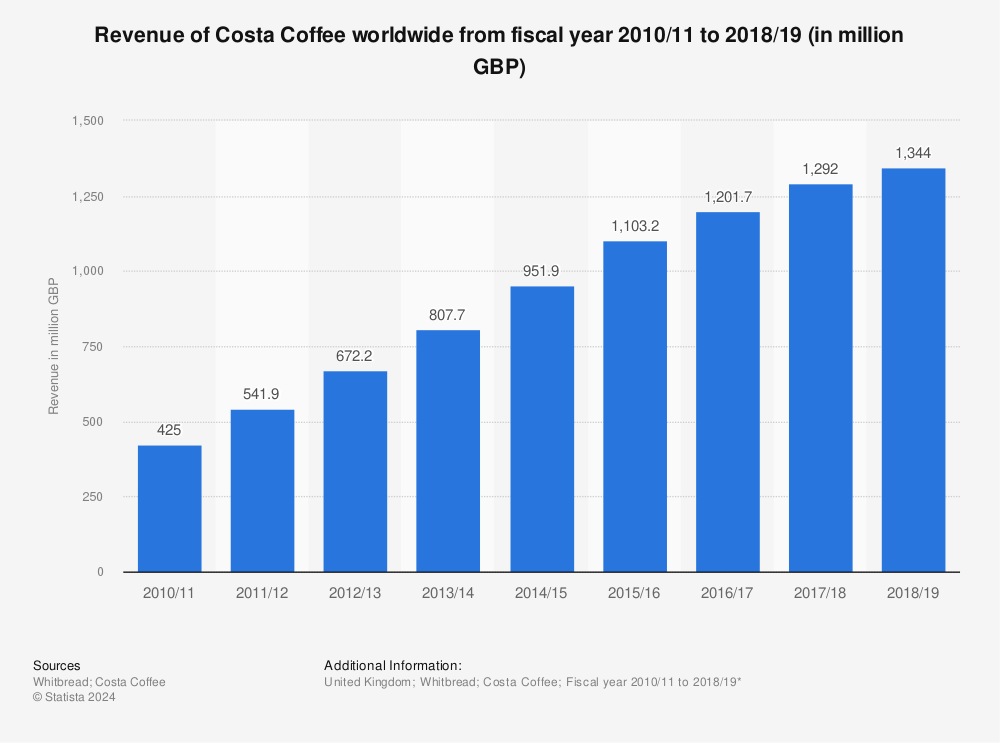

Costa Coffee Revenue 2010 2019 Statista

1961 is available to the individuals who have a yearly income up to Rs.

. On the First 5000. First of all you have to. This YA 2020 new tax reliefs have been.

Income tax relief on contributions for Employees Provident Fund EPF and payment for life insurance. Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking. This means that low-income earners are imposed with a lower tax rate.

Calculations RM Rate TaxRM 0 - 5000. Assessment Year 2018-2019 Chargeable Income. Personal income tax rates.

Lets take a look at some of the scenarios where these tax exemptions maybe applicable in Malaysia. Malaysias 2019 Budget will see an increase in stamp duties to 4 from 3 for transfer of real properties that are RM1 million and higher. 22 October 2019.

Malaysias finance minister presented the 2020 Budget proposals on 11 October 2019 and announced an increase in individual income tax rates by. Introduction Individual Income Tax. Here are the tax rates for personal income tax in Malaysia for YA 2018.

Education self claim allowed. 13 rows An individual whether tax resident or non-resident in Malaysia is taxed on any income accruing in or derived from Malaysia. Income Tax Slab Rates for FY 2019-20 AY 2020-21.

Posted on March 8 2022 1 min read. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. Types of Contribution allowed for Personal Tax Relief Individual Relief Types Amount RM 1.

The Annual Wage Calculator is updated with the latest income tax rates in Malaysia for 2019 and is a great calculator for working out your. If your income falls below the governments. Rahman Enterprise Chargeable Income for the YA 2019 Section 4a RM RM Profit before tax 5 Allowance for stock obsolescence 1 of cost 36 Allowance for warranty 24 Property plant.

A video step-by-step guide to accompany our earlier post about how to file your personal income tax in Malaysia in 2019 as an expat or. The following is the summary of tax measures for Malaysia Budget 2019. Based on this table there are a few things that youll have to understand.

Tax Rates for Individual. Medical Expenses for Parents OR Parent Limited 1500 for only one. There will be a two-year stamp duty.

Housing and meal allowances or their value. Self Dependent 9000 2. Assessment Year 2019 Individual Taxable Income for the first RM35000 is RM900 and calculate on 10 for the next RM15000 of total income.

Malaysia Annual Salary After Tax Calculator 2019.

10 Things To Know For Filing Income Tax In 2019 Mypf My

Gst In Malaysia Will It Return After Being Abolished In 2018

Individual Income Tax In Malaysia For Expatriates

Save Thousands Of Dollars In Taxes With A Student Visa Go Study Australia

Public Satisfaction With The Nhs And Social Care In 2019 The King S Fund

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

How Much Does A Small Business Pay In Taxes

:max_bytes(150000):strip_icc()/3MWord-c3d696cde10640509f532aaa5e36791d.jpg)

The Difference Between Record Date And Payable Date

Malaysia Average Monthly Household Income By Ethnic Group 2019 Statista

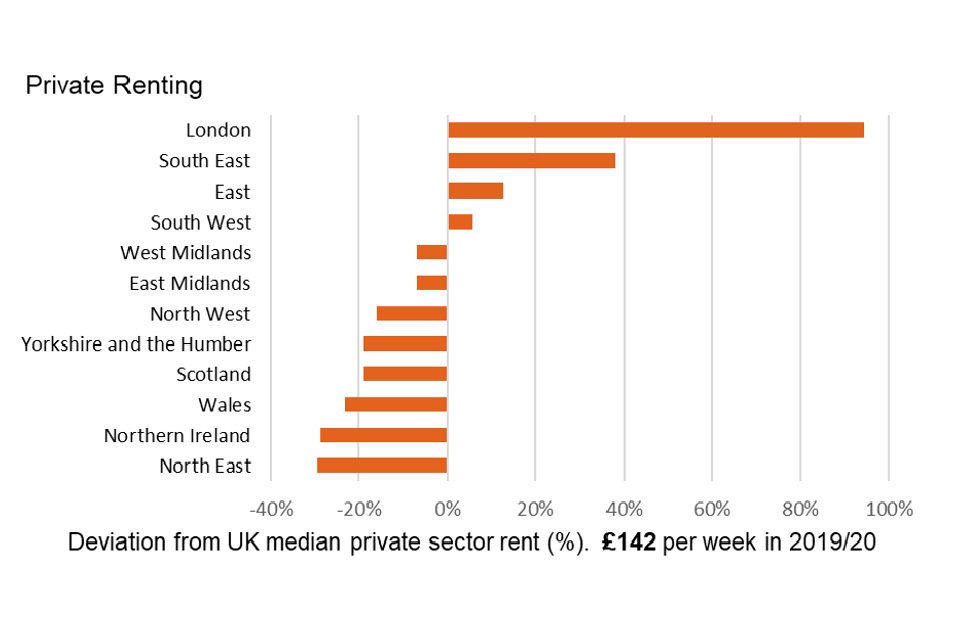

Family Resources Survey Financial Year 2019 To 2020 Gov Uk

Download The Payslip Template From Vertex42 Com Payroll Template Templates Excel Templates

Lhdn Irb Personal Income Tax Relief 2020

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

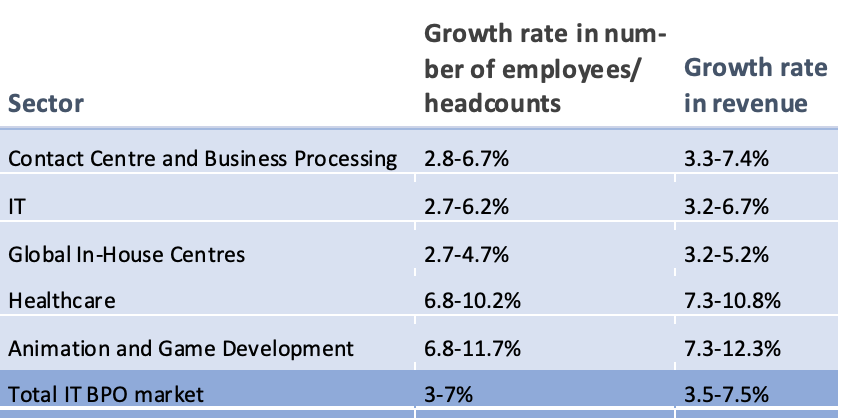

Covid 19 And The Philippines Outsourcing Industry Lse Southeast Asia Blog

Sources Of Revenue For The States Insightsias

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

China Loan Prime Rate 5y August 2022 Data 2019 2021 Historical

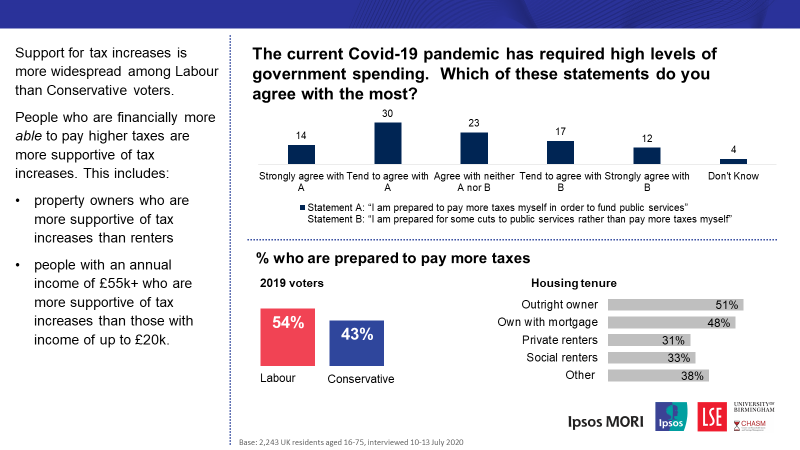

Britons Support Paying More Tax To Fund Public Services Most Popular Being A New Net Wealth Tax Ipsos